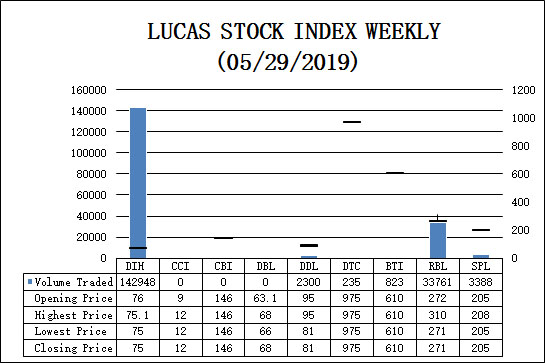

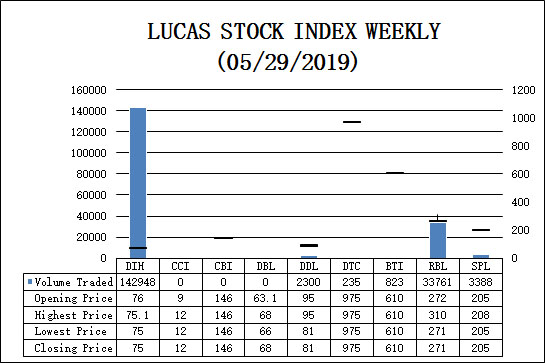

LUCAS STOCK INDEX

Last Update: 558.05 Movement: 3.73% Current Update: 537.22 YTD Movement: 4.34% The Lucas Stock Index (LSI) declined 3.73% during the fourth period of trading in May 2019.

Last Update: 558.05 Movement: 3.73% Current Update: 537.22 YTD Movement: 4.34% The Lucas Stock Index (LSI) declined 3.73% during the fourth period of trading in May 2019.

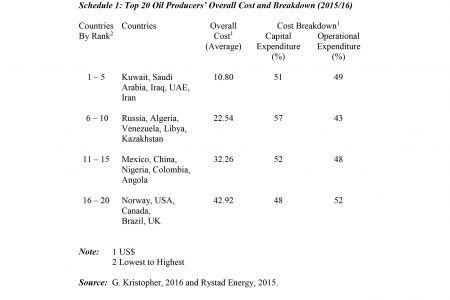

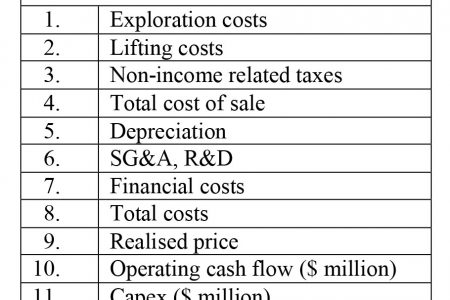

Introduction Under Guidepost 6 of Guyana’s Petroleum Road Map, in its dimension for “getting petroleum revenues” I have offered, thus far, three sets of unit cost metrics, which were completed in 2018.

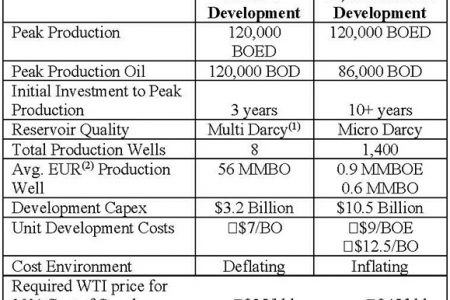

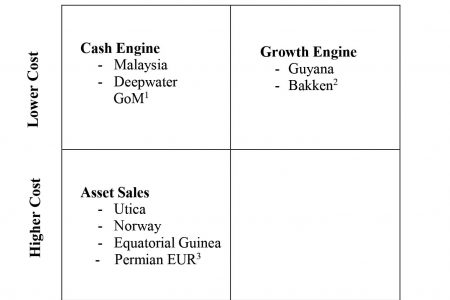

Introduction For the purposes of Guidepost 6 as listed in my presentation of Guyana’s Petroleum Road Map for its dimension of “assessing expected petroleum revenues”, I have already considered Hess Corporation’s cost metrics.

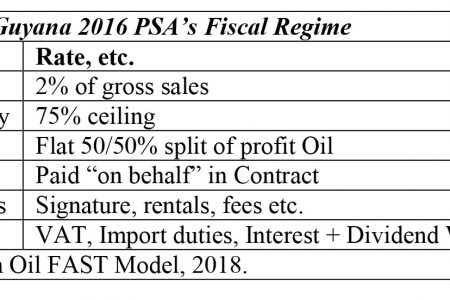

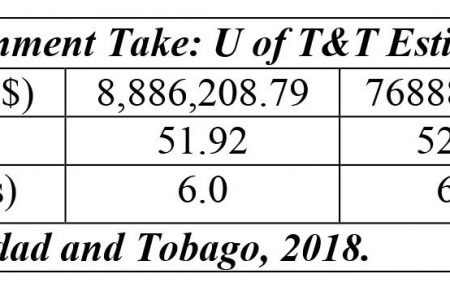

Introduction Today’s column evaluates the University of Trinidad & Tobago’s (U of T&T) modelling of the Liza Field Development.

Introduction In last week’s column, I had introduced Hess Corporation’s oil assets portfolio as presented by its Chief Executive Officer (CEO) to the “Barclays Energy — Power Conference,” held in September, 2018.

Introduction For the fourth week in succession, I shall continue my evaluation of the cost-price-profit profile for Guyana’s expected petroleum sector.

Introduction Today’s column continues my presentation on Guidepost 6. As observed earlier, this Guidepost is crucial for my estimating Guyana’s anticipated petroleum revenues.

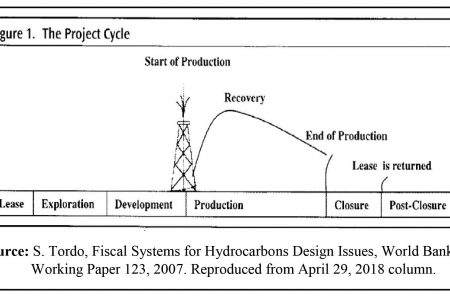

Introduction In this week’s column, I begin consideration of Guidepost 6, as listed in my Guyana Petroleum Sector Road Map, for the dimension of “getting petroleum revenues.”

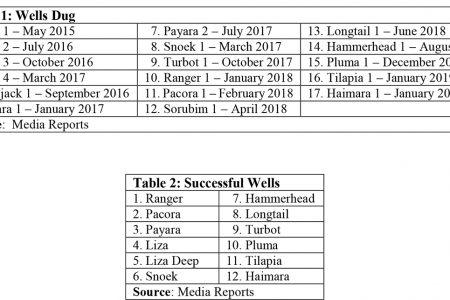

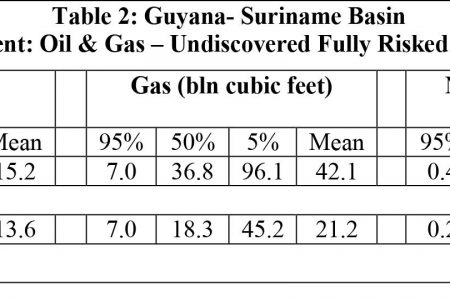

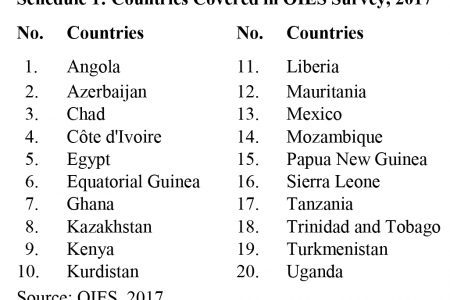

Introduction This week’s column considers Guidepost 5 in Guyana’s Road Map for its petroleum sector in the dimension: “getting petroleum resources.”

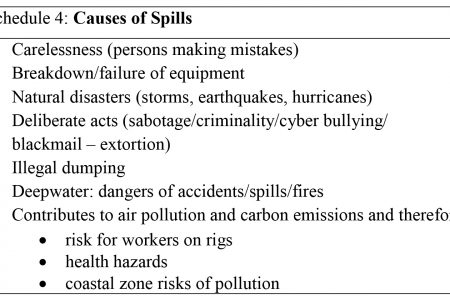

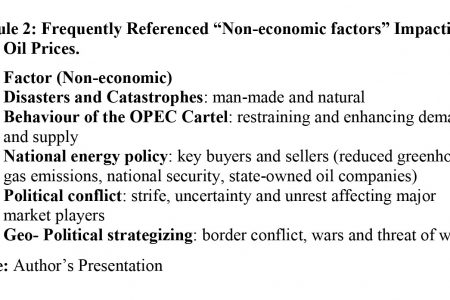

Introduction Today’s column summarily considers the two remaining existential threats to Guyana’s coming petroleum sector, which I have identified for the Road Map; namely: 1) a cataclysmic environmental event occasioned by petroleum extraction, and 2) the geo-strategic spillover from domestic political strife/conflict.

Introduction Today’s column addresses the first listed, and perhaps the most pressing of the three existential threats to the materialisation of Guyana’s petroleum sector and its projected Government revenues.

Introduction Empirical observations, research and analysis, along with widely recorded historical experiences reveal that, beyond doubt, Guyana’s coming time of oil and gas production and their export will be fraught with severe risks.

Introduction Thus far, I have considered two of the six Guideposts in my depiction of a Road Map for the Government of Guyana (GoG) “getting its petroleum revenues” dimension.

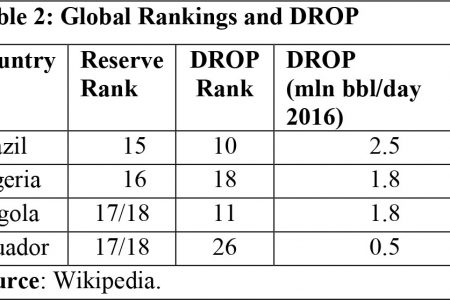

Introduction Last week I addressed two of the four lines of justification, which I advance in support of my bullish prediction of 13 to 15 billion barrels for Guyana’s oil reserves.

Introduction Today’s column presents my justification for the “bullish estimate of 13 to 15 billion barrels of high quality oil as Guyana’s reserves potential.”

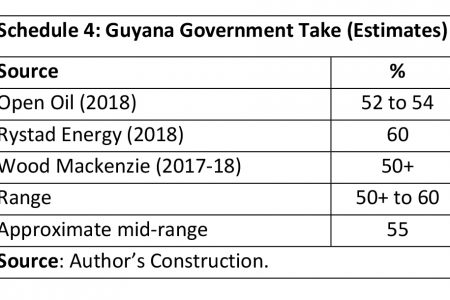

Introduction Last week’s column indicated that, based on three published estimates of Guyana Government Take, the Strategic Road Map is premised on the country receiving the average of these estimates – 55 percent.

Introduction Last week’s column offered a summary outline of my Strategic Road Map for “getting and spending” Guyana’s anticipated petroleum revenues.

Introduction Today’s column commences my first systematic delineation of a Strategic Road Map for getting and spending Guyana’s expected Government Take from the petroleum sector.

Introduction Today’s column concludes my discussion of fiscal stabilization clauses (FSCs) in Production Sharing Agreements (PSAs).

Introduction As promised, today’s column addresses the final topic in the now long running series (started September 2016) on Guyana’s coming petroleum sector, namely, its fiscal stabilization clause.

The ePaper edition, on the Web & in stores for Android, iPhone & iPad.

Included free with your web subscription. Learn more.