OPEC, Russia prepared to raise oil output amid U.S. pressure

ST PETERSBURG/DUBAI, (Reuters) – Saudi Arabia and Russia are discussing raising OPEC and non-OPEC oil production by some 1 million barrels a day, sources said, weeks after U.S.

All the latest news and commentary on the new Guyana Oil and Gas sector include exploration, drilling, policy, impact and more.

ST PETERSBURG/DUBAI, (Reuters) – Saudi Arabia and Russia are discussing raising OPEC and non-OPEC oil production by some 1 million barrels a day, sources said, weeks after U.S.

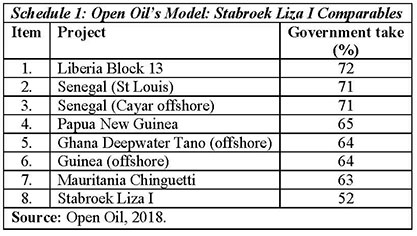

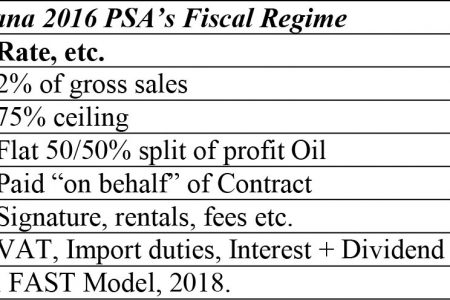

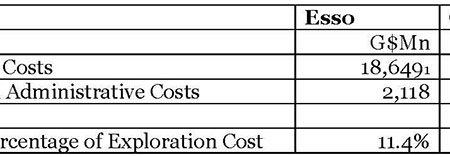

Responding to Open Oil Today’s column addresses the third part of my three-part evaluation of Open Oil’s financial modeling of Guyana’s 2016 PSA.

Guyana has struck oil but for the panelists at a discussion on Wednesday there is no reason to celebrate.

Twenty-five students drawn from five of the country’s administrative regions are participating in the first ever programme in oil and gas operations by the Guyana Trades Union Congress-administered Critchlow Labour College, which commenced at the College’s Woolford Avenue Complex yesterday. General Secretary of the GTUC, Lincoln Lewis who is Chairperson of the College’s Board of Directors told Stabroek Business earlier this week that the significance of the two-day programme reposed in the commitment of the College “to remain in the mainstream of relevant education notwithstanding the challenges.

Introduction After the major financial issue last week, we return today to the mundane issue of the provisions on non-associated gas in the 2016 Agreement which the three oil companies signed in June 2016.

Dear Editor, I refer to the letter, `Why is Janki so opposed to the ExxonMobil deal?’

Introduction: Findings Today’s column addresses Part 2 of the proposed three-part evaluation of Open Oil’s financial modelling exercise of Guyana’s 2016 PSA.

Guyanese comprise fifty-two percent of ExxonMobil’s local workforce while 227 Guyanese companies serviced its oil and gas operations in 2018.

Dear Editor, On May 17th, 2018 the Stabroek News published a letter by Mr Clement Smith in which he questioned the motives of A Fair Deal for Guyana with respect to challenging the oil contract.

LONDON, (Reuters) – A decade ago, the news that the world’s top oil and gas companies had less than 12 years of production left in their reserves might have caused a panicked sell-off in their shares.

Column 43 dealt mainly with Associated Gas and my plan was to deal with non-associated gas this week.

HOUSTON, (Reuters) – Venezuela’s state-run oil firm PDVSA has bought nearly $440 million worth of foreign crude and shipped it directly to Cuba on friendly credit terms – and often at a loss, according to internal company documents reviewed by Reuters.

Introduction Within hours of the publication of my last Sunday’s Stabroek column, where I had indicated my intention to write a “three-part review of Open Oil’s reported financial modeling exercise of Guyana’s 2016 PSA”, its Founder and Author of the exercise wrote to the Stabroek News Editor “to correct some inaccuracies” (letter published, Monday, May 7, 2018).

Part 43 One feature of the Esso/Hess/CNOOC 2016 Agreement – as indeed the 1999 Esso Agreement signed by President Janet Jagan – which has received little public attention is Gas which is addressed in Article 12 of both Agreements.

The possible purchase of Guyana’s gold and crude oil and India’s expertise in the rejuvenation of polluted waterways, were among areas discussed.

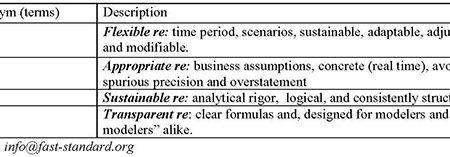

Dear Editor, I am writing to correct some inaccuracies in a review by Dr Clive Thomas of our financial model of the Stabroek field in his column in the May 6th Sunday Stabroek: He states that “Open Oil has developed its own financial model called the FAST Modeling Standard”.

Introduction Since its appearance in mid-March several readers (I suspect largely students) have been urging me to appraise and/ or review the recent financial modeling exercise carried in sections of the media, and which has been conducted by Open Oil, on Guyana’s 2016, production sharing agreement, PSA.

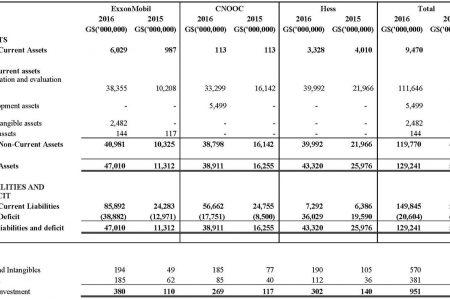

Introduction Column 41 which appeared two weeks ago looked at the paltry share capital of the three foreign oil companies which signed the 2016 Petroleum Agreement for the Stabroek Block.

Dear Editor, Is Guyana thinking of rising oil? Are Guyanese preparing for what that means?

Scenes from the closing ceremony of the Civil Defence Commission’s Oil Spill Response Training exercise held at Splashmins.

The ePaper edition, on the Web & in stores for Android, iPhone & iPad.

Included free with your web subscription. Learn more.